Buyers

Best Candidates to Purchase Film Tax Credits

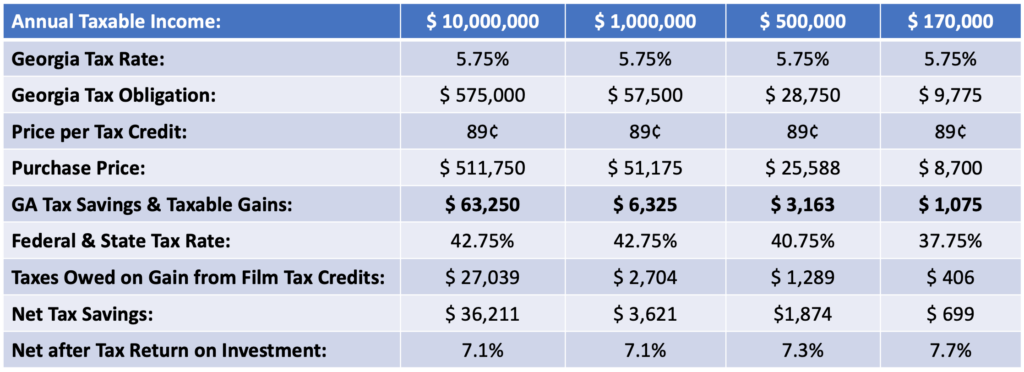

Georgia taxpayers who have a taxable obligation over $10,000 and/or taxable income over $170,000 should consider film tax credits. Individuals, corporations and trusts can all utilize film tax credits to reduce their overall Georgia state taxable liability.

Financial Benefits of Film Tax Credits

- They reduce the taxpayers total tax liability owed to the Georgia Department of Revenue.

- Film tax credits can be used as a treasury management tool allowing taxpayers to withhold quarterly estimated payments during the year by purchasing film tax credits before their tax filing deadline.

- Film tax credits can be applied retroactively to the prior three-year tax returns. The client is only required to amend their state tax return, not their federal tax return.

- Film tax credits carry forward 5 years from the date they were issued from the production company, not from when the client purchased the credits.

- CPAs and Financial Advisors can off-set the cost of their services by recommending film tax credits as a value-add service.

Frequently Asked Questions

Entertainment tax credits are tax incentives for production companies to encourage economic development within the state.

The most common entertainment tax credits that we broker are Georgia film tax credits. The State of Georgia implemented the Georgia Entertainment Industry Investment Act (the “Act”) in 2008. The Act incentivizes production companies to locate their production activities in Georgia by offering a transferrable entertainment tax credit to the production company up to 30% of their qualified expenditures. These tax credits are transferable (only once) to any taxpayer (individual or corporation) with a Georgia income tax liability.

Generally, any individual or entity who has state income tax liability in the state where the credit is generated may benefit. This includes individuals, corporations, partnerships, limited liability companies, trusts and insurance companies (insurance premium tax). However, there are some exceptions, such as Connecticut tax payers and their related entertainment tax credits. In Connecticut, film tax credits will offset insurance premium tax up to 55% and corporations can offset state income tax up to 70%. However, Connecticut film tax credits are not eligible to offset individual income tax liability.

Film tax credits may be used to amend prior year tax returns. Each state governs its entertainment tax incentive program differently so please speak with your tax advisor or contact one of our representatives concerning the specifics for your state of residency.

Each state has different regulations that govern the rules and restrictions for their state’s entertainment tax credits. For additional information, please speak with your CPA or tax advisor.

- Georgia

Each state governs their entertainment tax credit incentive program differently and determines how many tax credits are generated from each production company and the related transfer limitations. Several states also have limits on the total amount of credits that can be generated in a given year.

Since each state manages its entertainment tax incentive program differently, please speak with your tax advisor or contact one of our representatives concerning the specifics for your state of residency.

Entertainment tax credits have an extremely low level of risk which is further mitigated by obtaining an opinion letter (i.e. comfort letter) prepared by an independent CPA firm or having an audit completed by the issuing state’s Department of Revenue, both of which are discussed further in a separate tab.

Entertainment tax credits are authorized and managed by the specific state offering the incentive. Each state is very specific regarding the rules related to awarding and transferring these credits, which reduces the risk to the purchaser (taxpayer) and seller (production company).

All entertainment tax credits brokered by Ornstein-Schuler State Film Tax Credits are verified through either an audit performed by the issuing state’s Department of Revenue or a CPA opinion letter (i.e. comfort letter) that independently verifies that the production company qualifies for the entertainment tax credits and guarantees the credit if recapture should occur.

A Department of Revenue audit letter certifies the tax credit claimed by the production company, which eliminates any future audit risk. The advantage of these tax credits is that they have already been approved by the state Department of Revenue.

The CPA opinion letter supports the accuracy of the film tax credits that the production company is claiming; however the State Department of Revenue may audit the production company. Recapture of the tax credits could occur should the state Department of Revenue come back and determine that some or all of the tax credits are not eligible to be awarded to the production company. However, any recapture concerns are fully mitigated since the production company is held liable for making the buyer of the entertainment tax credits whole, meaning if recapture occurs, the production company will repay the buyer’s original purchase price for the tax credits including any penalties, interest and attorney’s fees. Ornstein-Schuler State Film Tax Credits brokers tax credits for quality production companies that use reputable, independent CPA firms to verify that all tax credits awarded are fully substantiated.

- The Buyer’s tax information is needed to complete the tax credit transfer agreement, which includes the following:

- Full Legal Name

- Address

- Social Security Number

- Email Address

- Cell Phone Number

- Amount of Credits to be Purchased

- Tax Year

- CPA Contact Information

- The Buyer will receive a secure email from Docu-Sign that will include your documents to view and sign;

- The Buyer will receive an invoice via email from Ornstein-Schuler State Tax Credits with payment instructions;

- The Buyer will wire or ACH transfer their funds according to the invoice;

- Ornstein-Schuler State Film Tax Credits or the production company will file the necessary paperwork with the Department of Revenue to substantiate the purchase and transfer of the related tax credits;

- Ornstein-Schuler State Film Tax Credits will provide the final tax filing documents which include the IT-TRANS form (in Georgia). This form is needed for claiming the tax credits which your tax advisor will include with your state tax return.

The full purchase and transfer process can take between 2 to 3 weeks.

The process is different from state to state. Please speak with your tax advisor or CPA concerning claiming entertainment tax credits in your state of residency.